In the Asian Banker Annual China Awards 2021, recently announced by the authoritative financial media 'Asian Banker' magazine, China Merchants Bank (CMB hereafter) won the Achievement In Liquidity Risk Management, which is the only award in liquidity risk management.

Being one of the annual awards that have attracted lots of attention and recognition in the financial services industry, the Asian Banker Award has pushed its boundary to cover today's disruptive technology and industrial innovation from the original traditional fields such as retail banking, risk control, and financial market since its establishment in 2006. The award winners are selected based on the comprehensive evaluation by the international advisory committee composed of well-known scholars and industry leaders. It has obtained high authority and brand reputation in the industry for its strict, fair and transparent selection process.

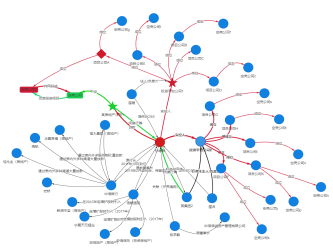

The building of graph-database-empowered liquidity risk management graph system is a pioneering attempt by staff from the business and technology departments of CMB, fulfilling Basel III core monitoring indicators by fully utilizing the real-time high-performance computing power and 3D visualization ability of Ultipa Graph Database. CMB's liquidity risk management graph system has continuously realized the exploration and innovation in the fields of scientific measurement and deep penetration of per-transaction financial risk, real-time liquidity risk index monitoring, and so on, which is also a worldwide first case of using graph technology to explore and manage liquidity risk.

As CMB is undergoing a transformation into its 3.0 Model, Ultipa Graph will play a greater role in CMB's Big Fortune Management Value Chain with its features of 'faster, more accurate and more capable'. More and more applications of graph computing are to come in the fields of intelligent customer service, intelligent investment consultant, customer graph, industrial graph, smart marketing and risk control, anti-fraud and smart decision-making.

_1.png)